Ability to upgrade models during the term

No long term commitment required

Choose a provider and negotiate the final agreement

Compare models before making a long-term purchase

Choose the Right Business for Your Business

Page Volume Allowances and Overage Fees

Get training on the new equipment

Purchasing equipment can be advantageous for businesses that have a steady demand for printing.

Technology can be upgraded more frequently

Lease payments are made monthly

Service and supplies bundled into rental fees

Response time and uptime service guarantees

Add up all the costs for buying and leasing over a period of 3-5 years to determine total ownership cost. This allows you to compare the two options over a similar term.

Cash Flow - Leasing offers predictable payments; buying may impact cash flow with large initial payment

Steps to Lease a Copier or Printer

Ongoing maintenance and supply expenses

Usage volume requirements and capacity

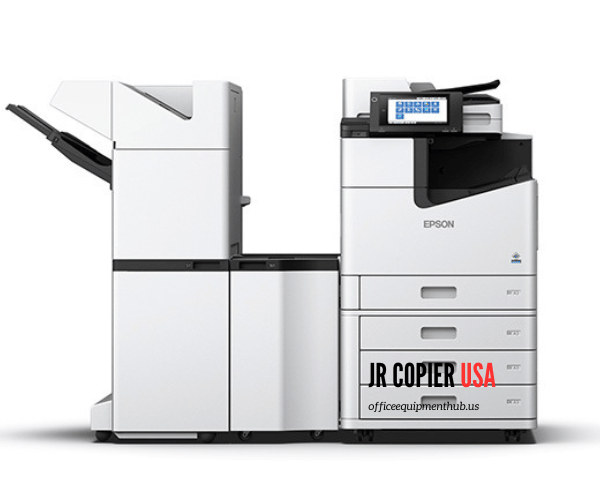

Considerations to make when purchasing a new multifunction printer or copier:

Power consumption - ENERGY STAR ratings to help reduce costs

When evaluating a lease for a MFP/copier, there are several factors to consider:

Purchases or Down Payments - Costs upfront

Minimize costs when needs are only short-term

Lease vs. Buy Copier Cost Analysis

If you only need equipment for a short period of time, such as a few weeks or months, renting may be a better option than leasing or buying. Copier rentals are available on a monthly basis with flexible terms.

When purchasing copiers, printers, and MFPs, it helps to:

Maintenance and supply costs

Assess your printing and copying requirements

Depreciation of purchases can provide tax benefits

To decide between leasing and buying, it's important to compare total costs over the useful life cycle of the equipment. Major factors to include in the cost analysis:

These steps will help you make an informed decision about the best copier or MFP to suit your needs.

Rental terms for copier/MFPs:

Many companies have found leasing to be a very popular option. Leases are based on a fixed monthly payment that covers the use of equipment for a specified period, such as 3 to 5 years. You can either return the equipment at the end of your lease or buy it.

Considerations when evaluating a copier/MFP lease:

Page volume allowances and overage fees

Supply/consumables costs

Call for service promptly when problems arise

It is important to consider the following when purchasing copiers, MFPs and printers:

For sporadic needs, short-term rentals provide access to equipment without a major investment. Rental costs are generally deductible as a business operating expense as well.

Pages per Minute (PPM) is the measurement of print and copy speed.

No commitment needed

If you analyze these differences in relation to the specific circumstances of your situation, it will be easier for you to determine whether leasing or purchasing makes more sense financially and operationally.

Get quotes from 2-3 authorized dealers at minimum

Schedule delivery and installation

Taking these steps allows you to make a well-informed purchasing decision on the right copier or MFP for your specific needs.

The perfect lease will fit your current and future usage levels, while also providing your business with the services and capabilities it needs. Working with an authorized dealer who is knowledgeable about your business environment will help you structure the best lease agreement.

Update firmware and drivers

Compare lease offers from different providers, negotiate terms, and consider refurbished or lower-volume models for affordability.

Research and partner with reputable copier suppliers or leasing companies known for offering high-quality, reliable copiers.

Leasing offers benefits like lower upfront costs, maintenance included, flexible terms, and easy equipment upgrades.